You can see exactly what your business’ return on investment would be from using a tool like Chaser to protect and bring your revenue in faster. Go to the ROI calculator here, plug in yours or your clients credentials, and you can instantly see your yearly time and cost savings – as well as the monthly cost of delaying using AI and automation. These success stories highlight the tangible benefits of AI and automation, showing that with the right tools, businesses can achieve significant improvements in their AR processes. Sign up to a free course to learn the fundamental concepts of accounting and financial management so that you feel more confident in running your business. Typically, you as a business owner sell goods on credit to your customers.

Managing accounts receivable- why it matters

The customers to whom you sell goods or services on credit are recorded as trade debtors or accounts receivable in your books of accounts. That is, you record accounts receivable in general ledger accounts under the account titled ‘Accounts Receivable’ or ‘Trade Debtors’. Accounts Receivables are one of the important current assets of your business. Typically, you sell goods or services on credit to attract customers and augment your sales. Use a documented process to monitor accounts receivable, and to increase cash collections, so you can operate your business with confidence.

You’re our first priority.Every time.

Create and assign tasks from disputed invoices to accelerate the dispute resolution process. Centime is committed to protecting businesses with bank-level security. Our PCI SAQ A and SOC 1 certifications ensure that your data remains safe at all times. Monitor payment patterns by customers to ensure critical customers are paying on time. Give your customers the flexibility to update payment methods, select their preferred payment dates, and opt-out at any time.

- To further understand the difference in these accounts, you need an overview of a company’s balance sheet.

- Whether you are a buyer or supplier, learn how managed services can help you free up working capital.

- Bill (formerly branded as Bill.com) is an accounts payable and accounts receivable platform that’s fully web-based.

- For example, you buy $1,000 in paper from a supplier who sends you an invoice for the goods.

Related Accounting Software

Recommended chasing times use AI to observe debtor email opens and payment history, and calculate and pinpoint exactly the best time and day to chase them, to maximize your chances of prompt payment. Accordingly, Net Realizable Value of Accounts Receivable is a measure of valuing the accounts receivables of your business. Further, goods sold on credit https://www.accountingcoaching.online/ have a risk of non-payment attached to them. Thus, bigger the difference between Gross Receivables and Net Receivables, bigger the issue with your business’ trade credit and collection policy. Thus, Net Accounts Receivable are used to measure the effectiveness of your business’ collection process from customers to whom goods are sold on credit.

B2B Payments

The income statement is more reliable when you use the accrual method. We provide third-party links as a convenience and for informational purposes only. Intuit does not endorse or approve these products and services, or the opinions of these corporations or organizations or individuals. Intuit accepts no responsibility for the accuracy, legality, or content on these sites. This content is for information purposes only and should not be considered legal, accounting, or tax advice, or a substitute for obtaining such advice specific to your business. No assurance is given that the information is comprehensive in its coverage or that it is suitable in dealing with a customer’s particular situation.

Predict Payment Delays

Corcentric’s accounts receivable automation solutions offer guaranteed and fixed DSO on all receivables, shaving days off DSO and eliminating delinquency. By replacing manual processes, you can eliminate late payments due to disputes and reduce bad debt. An EIPP platform also enables your customers to self-service as well as providing a range of payment options such as faster payments, ACH, credit cards and all forms of online payment.

AR is its central focus, but Growfin is designed to be used in tandem with other accounting and finance tools. It uses AI and machine learning to power AR automation workflows and to provide real-time insights to accounting and finance teams. It also has ample collaborative features for dispute management and past-due collections. With so many different AR solutions out there, figuring out which one is right for you is tough.

It’s designed to help finance and accounting teams focus on higher-value activities by streamlining (and automating) as many manual processes as possible—and by providing excellent forecasting and analytics tools. Effectively managing accounts receivable is crucial for effectivebusiness accounting, which encompasses billing, payments,collections, and tracking. Your organization’s success depends onits ability to manage this AR lifecycle consistently and efficiently. In many ways, accounts payable is the opposite of accounts receivable.

Standout features of BlackLine include real-time risk profiling to help firms use existing data to gauge credit risk (and set credit terms). It also features automated collections management, instant payment/invoice matching, and enhanced AR intelligence tools. Accounts receivable automation software refers to digital solutions used to facilitate the invoicing process, tracking of payments, and optimization of the overall accounts receivable workflow for businesses. After extensive research and leveraging my experience, I’ve shortlisted and reviewed the best accounts receivable automation software to help you optimize your collections process. At Chaser, we want businesses to feel empowered to join us in changing the narrative from ‘writing debts off’ to ‘Never experiencing debts in the first place’.

Standout features of SoftLedger include custom billing metrics that are well-suited to usage-based billing and other custom metrics. SoftLedger also supports crypto accounting (and crypto payments) in the AR process. Standout features of Bill https://www.simple-accounting.org/how-to-start-a-virtual-bookkeeping-business-and/ include the combination of AR and AP in one platform, which helps managers oversee a more complete financial picture of money coming in and out. It also offers the option to send paper invoices via mail directly from the Bill platform.

Accounts receivable is money that a company is owed by its customers. It’s an asset because it has value, and it’s a current asset because it’s expected to be collected within the next 12 months. For example, businesses that collect payments over a period of months may have a larger dollar amount of receivables in the older categories.

Invite customers to a simplified enrollment process via email, offering them the choice to authorize autopay without logging in or through the customer portal. Improve client relationships by giving your customers an easy, secure way to pay by ACH or credit card. Unlock decision intelligence by removing time-consuming and error-prone processes involved in preparing, transforming, and visualizing data.

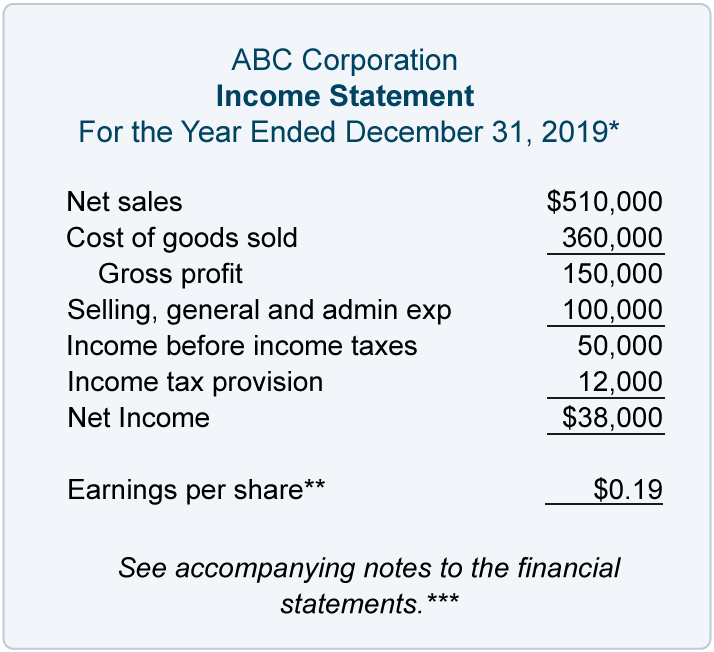

Thus, Ace Paper Mill will collect its average accounts receivables close to 5.66 times over the year ending December 31, 2019. Typically, businesses sell goods skillwise review on credit only to creditworthy customers. Still, good accounting practice requires you to keep some amount for accounts receivable that may not be paid.

The customers who may not pay for the goods sold to them are recorded as bad debts in the books of accounts. This report groups your accounts receivable balances based on the age of each invoice. A typical ageing schedule will group outstanding invoices based on 0 to 30 days, 30 to 60 days, etc. The goal is to minimise the amount of receivables that are old, particularly those invoices that are over 60 days old. By speeding up invoice delivery and payments, you reduce days sales outstanding (DSO), liberate working capital and improve cash flow for your business.

These tools can automate payment reminders, but they lack the sophistication needed to tackle the root causes of late payments. To automate the accounts receivable process and accelerate collections, businesses can implement AR automation software like Centime. Centime’s AR automation software simplifies the customer payment experience and improves working capital via automated payment reminders, secure payment methods, and documented customer interactions. For more tips on improving your collections process, check out this blog.

Related Posts

Bitwave Completes Integration with Stellar Blockchain,

The promise of this powerful combination is not just a game changer for the audit world, but also a benefit for organizations and a boost to investor confidence overall. In addition, the auditor can utilize the real-time...

Accounting For Startups: Everything You Need To Know In 2024

Startup accounting services companies can also help startups manage their cash flow, reduce expenses, and comply with tax regulations, all of which can contribute to long-term success. Zoho accounting software is part of the...

Accounts Receivable Automation AR Automation Software

You can see exactly what your business' return on investment would be from using a tool like Chaser to protect and bring your revenue in faster. Go to the ROI calculator here, plug in yours or your clients credentials, and...