A bookkeeping service can help you stay organized and on top of your finances. You should be able to access a dedicated bookkeeper for any questions or advice and one-on-one assistance. Merritt Bookkeeping costs a flat rate of $190 per month, with no restriction on the number of monthly transactions or the frequency of the service. The price is the same regardless of your business size and the number of employees. You can cancel your QuickBooks Live plan or upgrade from Live Expert Assisted to Live Expert Full-Service Bookkeeping at anytime.

Pro Small Business Accounting Software by Intuit

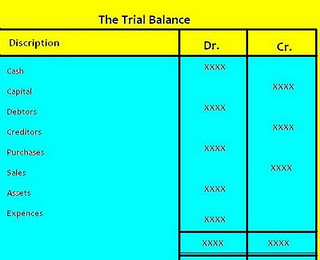

Some bookkeeping services can provide a full suite of bookkeeping, accounting and tax services. Examples include bookkeeping journal entries, bookkeeping ledger, bookkeeping reconciliation and bookkeeping trial balance. It’s also ideal for brand-new businesses because FinancePal can help with entity formation.

How A Bookkeeping Service Benefits Your Business

However, it aced pricing, which is based on several factors, including your company’s expenses and number of transactions. Catch-up bookkeeping is offered at 20% off the standard monthly rate but is only available to new clients who sign a one-year bookkeeping services contract. Brainy Advisors also offers add-on services assets not subject to depreciation like A/R and A/P management at $49 per hour. You don’t have to hire someone to come into your office to have an in-house bookkeeper — many are virtual. Using virtual bookkeeping allows you to outsource the day-to-day tasks that are a challenge to keep up with while also having a direct contact to ask questions of.

When should I hire a virtual bookkeeper?

Wave Advisors didn’t score well in terms of customer service, as it took a hit for not providing a phone number to call and not offering unlimited meetings. It also lacks a mobile app, and https://www.wave-accounting.net/ its bookkeeping services are limited, with the inability to pay bills or invoice customers. While Wave Advisors does provide payroll coaching, it doesn’t offer any customized services.

- Whether you go with a freelancer or a service like Bench, choosing what’s right with you starts with your bookkeeping needs.

- It advertises a start-from price of $200 but the fine print indicates that the first month of full-service bookkeeping is $500.

- These integrations make it easy to track your bookkeeping and accounting data in one place.

- The bookkeeper should have an agreement that clarifies exactly what services they’re providing, what you’re responsible for, and the terms of the relationship.

- You should be able to access a dedicated bookkeeper for any questions or advice and one-on-one assistance.

Ignite Spot Accounting: Best reporting

It also provides basic bookkeeping services like account reconciliation and financial statements, but not invoicing or bill pay. In terms of tax and consulting, it will file your income tax return but doesn’t handle sales tax or CFO advisory services. Bookkeeper360 is a good solution if invoicing, bill pay, customized services, sales tax filing, and CFO advisory services are what you’re seeking.

What kind of services do bookkeeping services provide?

If they are using different software and tools, you should figure out why and use that to determine if you really want to work with them. Our partners cannot pay us to guarantee favorable reviews of their products or services. Even if you aren’t planning on growing any time soon, you need to have a sense of how much money is coming in vs. what is going out. On top of that, you need the data used in bookkeeping to file your taxes accurately. If you want your business to save time and money, then you should consider hiring a bookkeeping service.

Bookkeeper360 offers a pay-as-you-go plan that costs $125 per hour of on-demand bookkeeping support. It’s an ideal plan for businesses that need minimal monthly support, though if you want more than two hours of help a month, you’ll save more money simply going with a service like inDinero or Bench.co. With Bookkeeper360, you’ll get a dedicated virtual accountant who sends detailed reports on a monthly basis. Virtual bookkeeping, also known as cloud accounting, is when a bookkeeper or accountant works with their client remotely.

Its services are built around the needs of startup companies backed by venture capitalists. While any of the bookkeeping services in this guide will help new businesses, Pilot focuses on new businesses with aspirations of becoming medium to large companies. Block Advisors aced our pricing category and received higher-than-average marks in the other criteria. It doesn’t offer a mobile app or unlimited meetings, so Bench is a better option in this case. However, with Block Advisors, you’ll be assigned a dedicated bookkeeper who will provide access to video meetings, and there is also a phone number to call if you need support.

It works with Quickbooks or Xero but you’ll need your own subscription to those services. Next, your bookkeeper will take on the monthly management of your books. With our resources and expert team, you’ll also get a full understanding of IRS requirements for mixing personal and business transactions based on your corporate entity.

QuickBooks Live is best for business owners who want to get their bookkeeping in order but don’t have the time or resources to do it. Danielle Bauter is a writer for the Accounting division of Fit Small Business. She has owned Check Yourself, a bookkeeping and payroll service that specializes in small business, for over twenty years. She holds a Bachelor’s degree from UCLA and has served on the Board of the National Association of Women Business Owners. She also regularly writes about business for various consumer publications.

Technological advancements have allowed small businesses to be able to afford the services they need. InDinero focuses on providing startups in the growth stage with accounting services to help them move toward an exit strategy. This service may be helpful in aiding you https://www.business-accounting.net/6-advantages-and-disadvantages-of-leasing/ in considering your startup’s financial options. Each customer’s main point of contact is a dedicated in-house, professionally-trained bookkeeper, based in North America. Part of what makes Bench unique is that we blend together the human touch with modern technology.

Related Posts

Virtual Bookkeeping Services for Small Businesses

A bookkeeping service can help you stay organized and on top of your finances. You should be able to access a dedicated bookkeeper for any questions or advice and one-on-one assistance. Merritt Bookkeeping costs a flat rate...

Accounting For Startups: Everything You Need To Know In 2024

Startup accounting services companies can also help startups manage their cash flow, reduce expenses, and comply with tax regulations, all of which can contribute to long-term success. Zoho accounting software is part of the...

Bitwave Completes Integration with Stellar Blockchain,

The promise of this powerful combination is not just a game changer for the audit world, but also a benefit for organizations and a boost to investor confidence overall. In addition, the auditor can utilize the real-time...